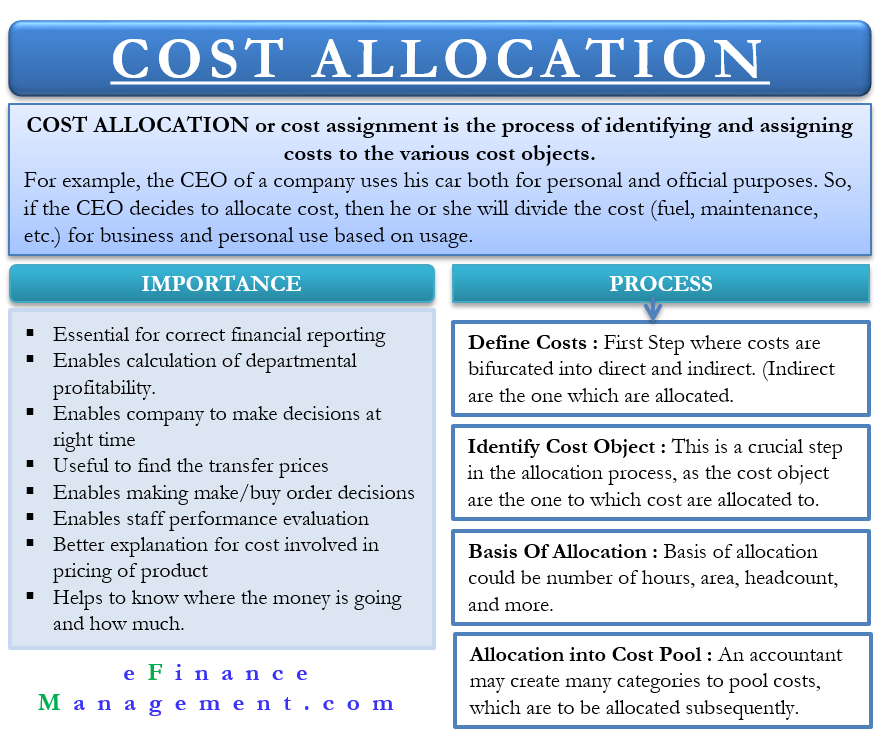

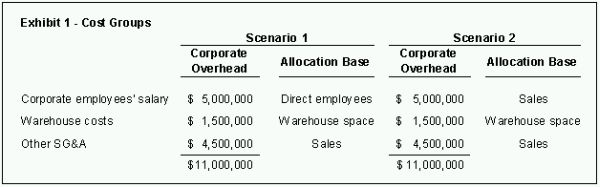

Allocation Of Fixed Overhead Costs: Significant Impact On Value - Corporate and Company Law - Canada

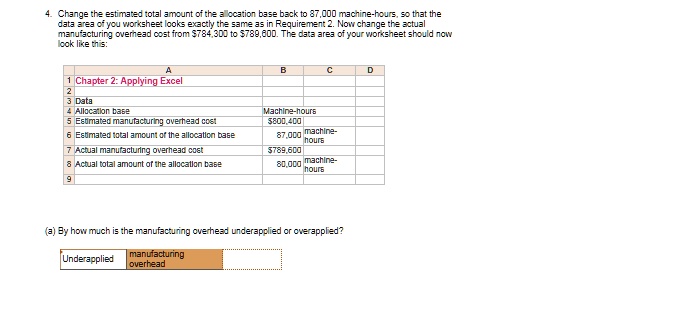

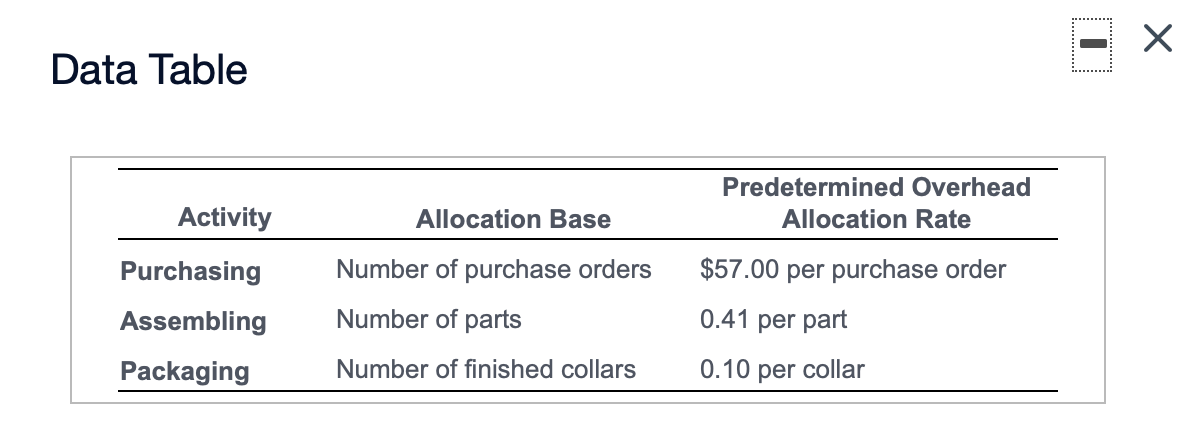

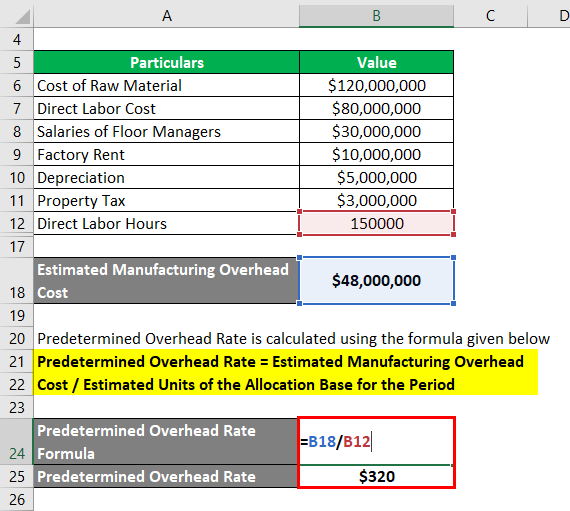

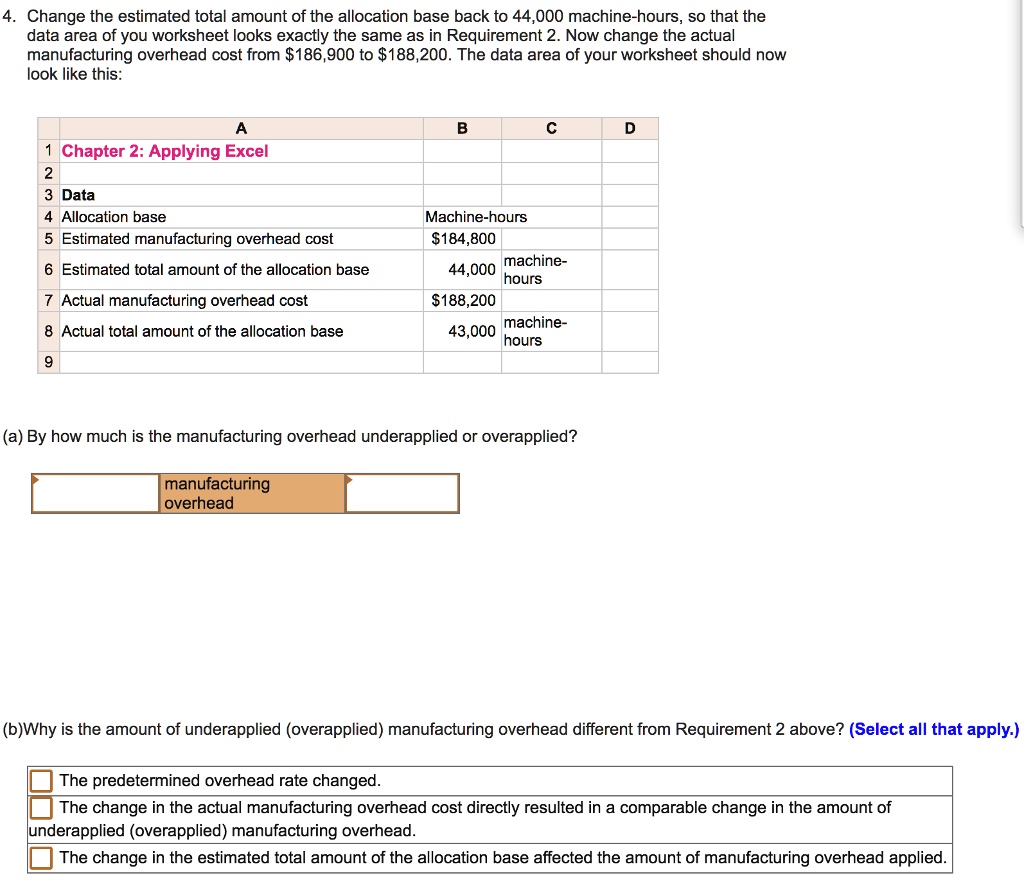

SOLVED: 4. Change the estimated total amount of the allocation base back to 44,000 machine-hours,so that the data area of you worksheet looks exactly the same as in Requirement 2. Now change

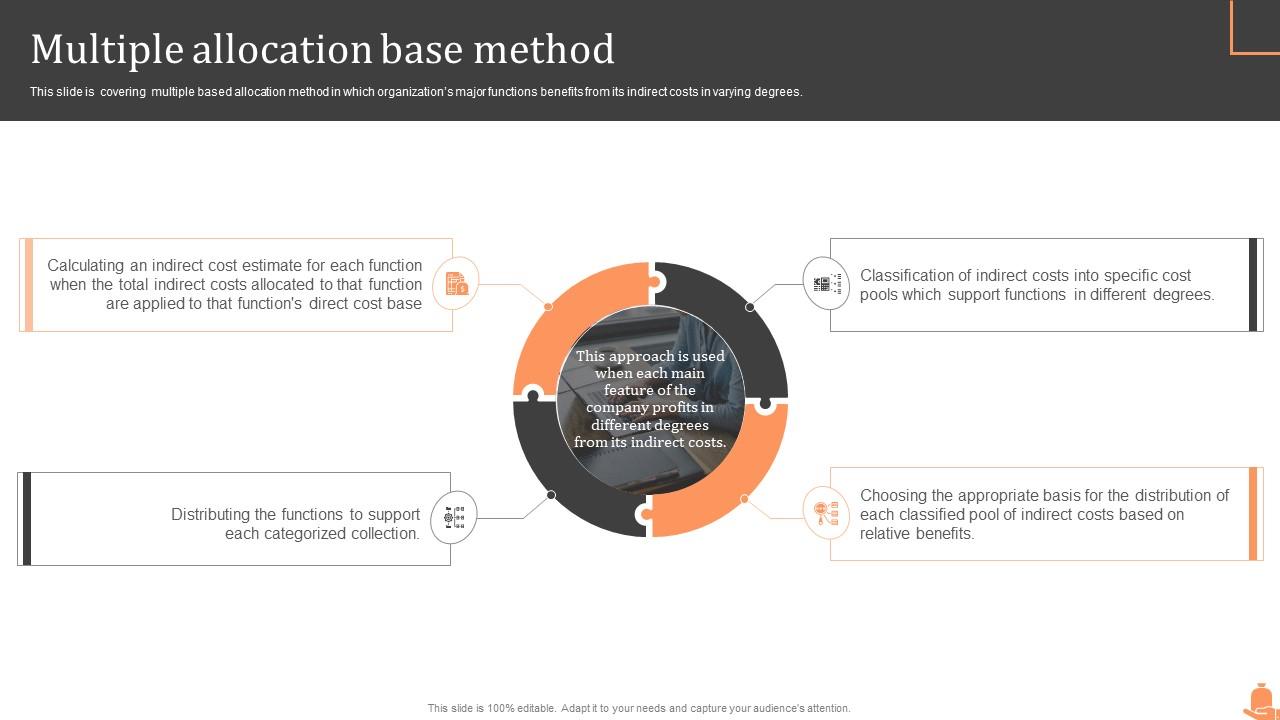

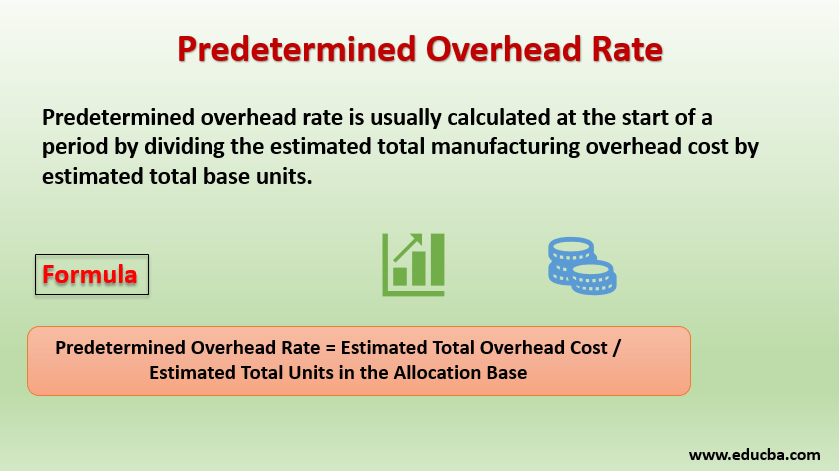

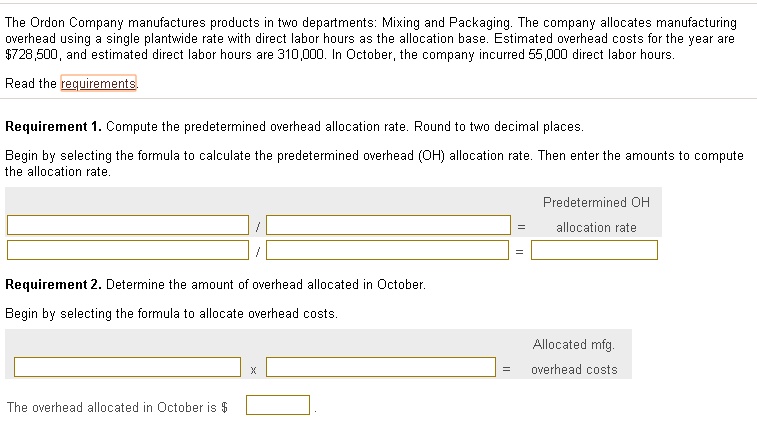

SOLVED: Drop Down Options: Requirement 1: Actual overhead cost, Actual qty of the allocation base used, Estimated overhead cost, Estimated qty of the allocation base Requirement 2: Actual overhead cost, Actual qty