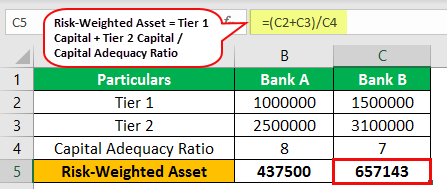

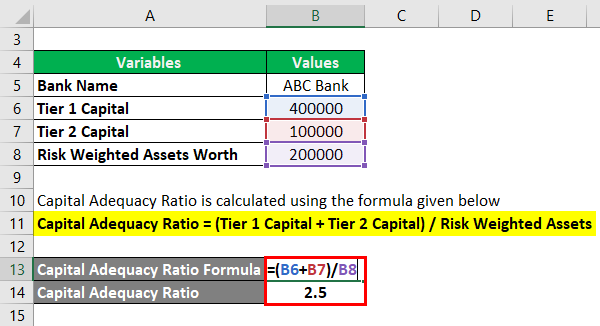

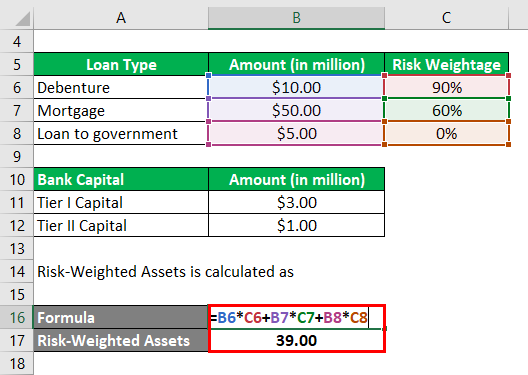

Dheeraj on Twitter: "Risk-Weighted Asset Definition (Formula, Examples) | Advantages https://t.co/t8U4glNhIR #RiskWeightedAssetDefinition https://t.co/LxE9ToypeP" / Twitter

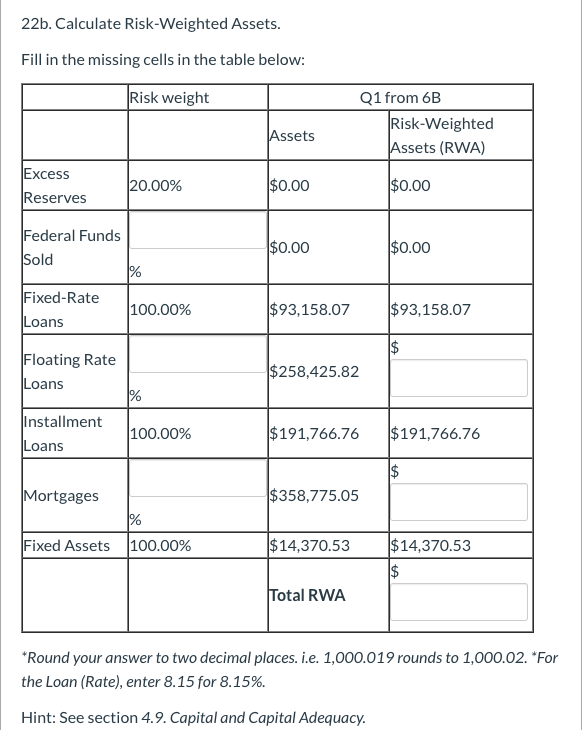

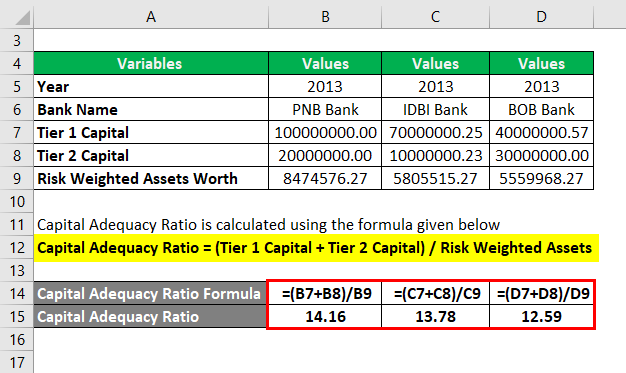

Table 3 from Risk-Weighted Assets Efficiency and the Target Capital Adequacy Ratio: A Case Study of Financial Holding Company Banks in Taiwan | Semantic Scholar