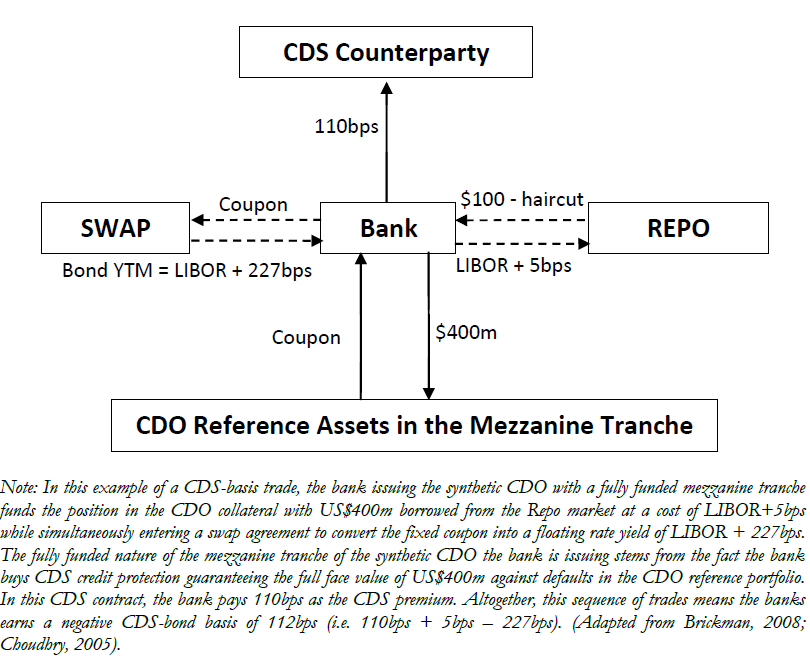

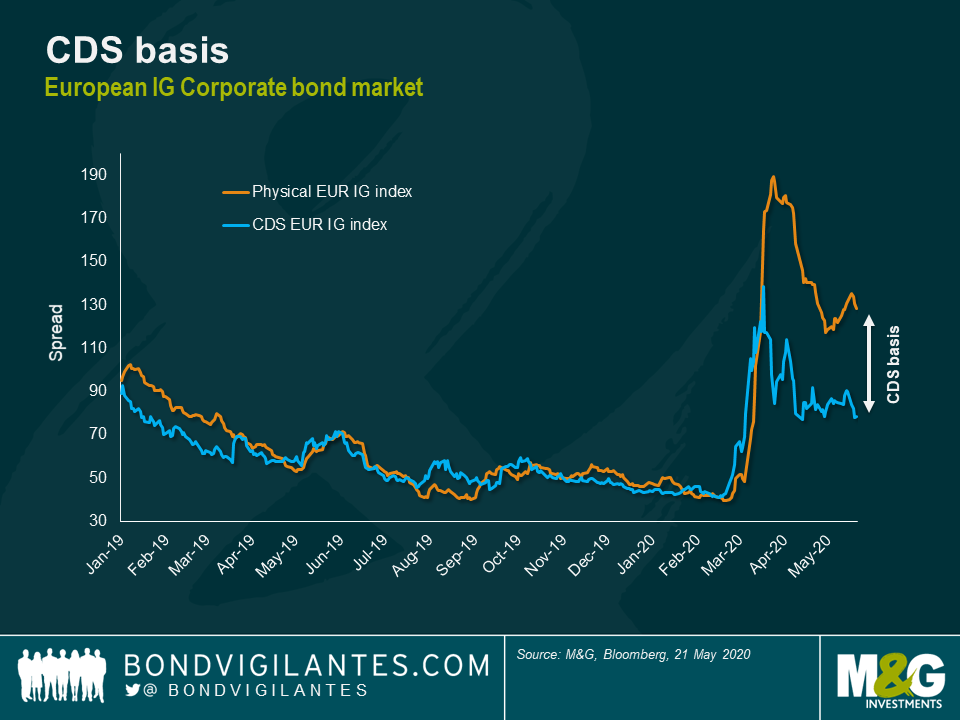

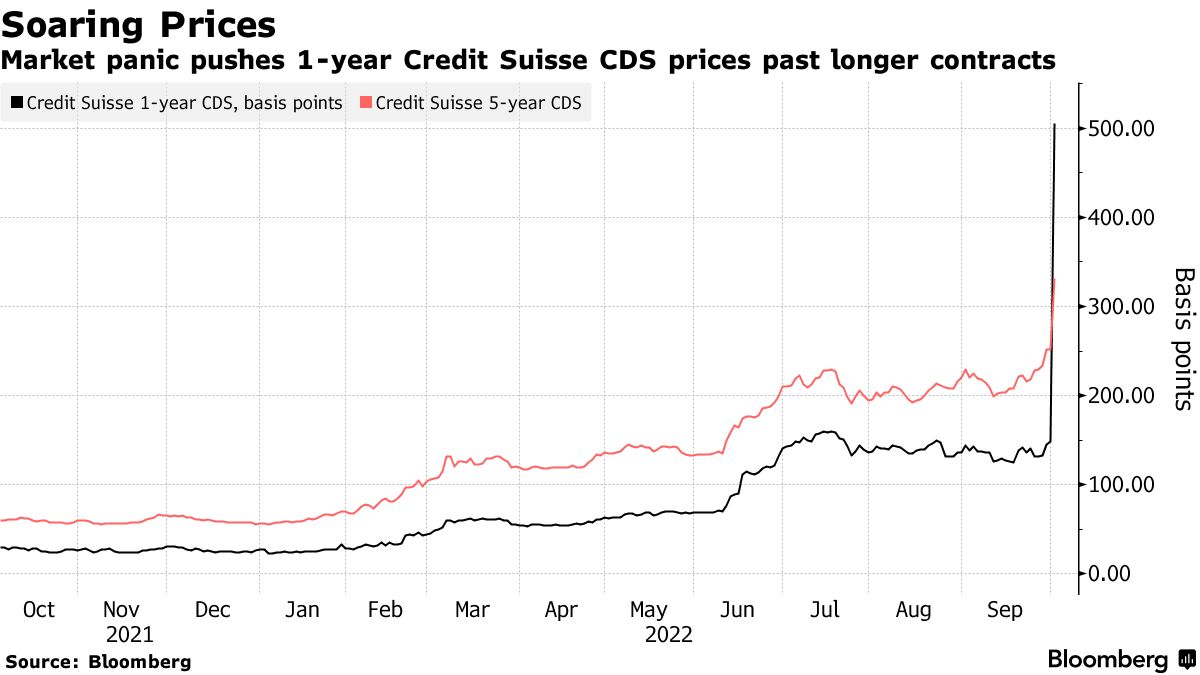

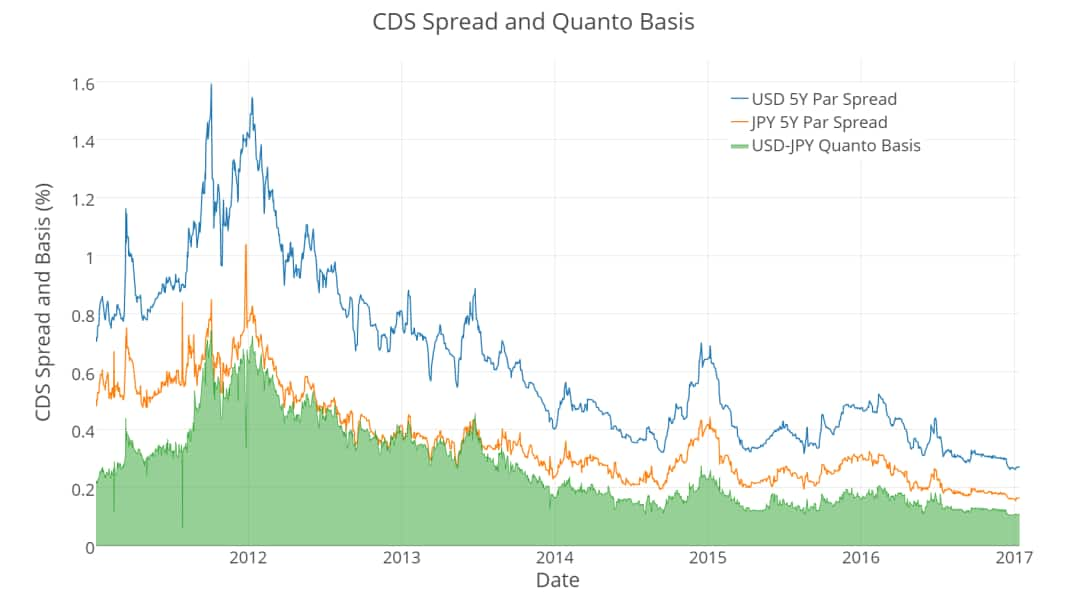

The Pricing of Credit Default Swaps During Distress in: IMF Working Papers Volume 2006 Issue 254 (2006)

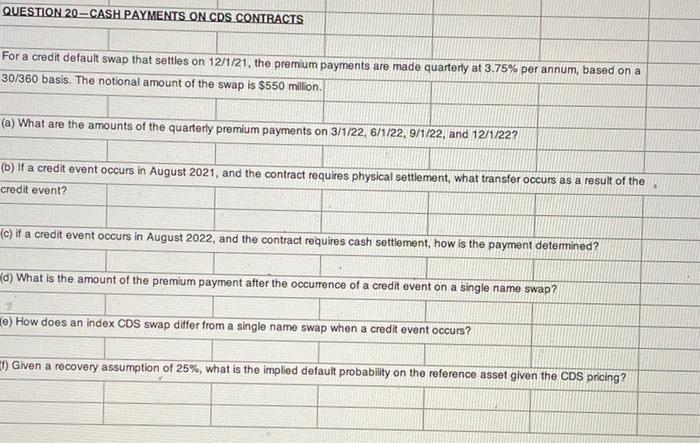

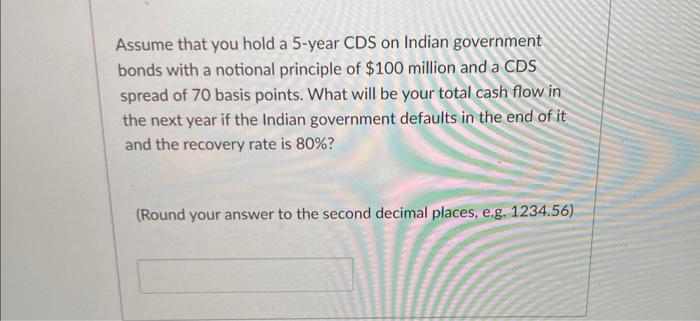

Credit Default Swaps A Credit Default Swap (CDS) is a contract in which the writer offers the buyer protection against a credit event in a reference name. - ppt download

:max_bytes(150000):strip_icc()/Term-Definitions_Credit-default-swap-63dfdd6f916e4dfa8fb524fc387273c6.jpg)